This month I stepped up my boat budget game. If you’ve been following our blog, you know we’ve been posting our expense reports for a few months now. Last month, I mentioned that I would *try* to be more comprehensive this month and I think I’m succeeding here. Let me know what you think! 🙂

This may not have been the best month to start trying to really track every penny … it certainly wasn’t a “normal” month for us financially. But, I’m posting it because, I figure, the more we know, the better we’ll do. And we can definitely do better!

For those of you that don’t know us, we’re a family of four living aboard our 40-foot sailboat in Portland Oregon. We’ve been living here in a marina for a couple years now, and we’ve got plans to leave the area and head up to the Puget Sound next spring or summer.

October 2018 Income

We had some extra income this month: I sold my beloved Mazda 3 which I’d owned for the past decade. It was our third car, though, and we definitely didn’t need to keep it. So that helped with an extra income of $2,900 and plus the $42 that we’ll save every month on the car insurance.

Cleaned up pretty nice.

In addition, in my attempt to be more accurate with my tracking, we’re now also including the $460/month that goes directly from Brenden’s paychecks to pay for our medical insurance. So that is tracked in income and expenses both.

Here’s our October 2018 total income: $8,180

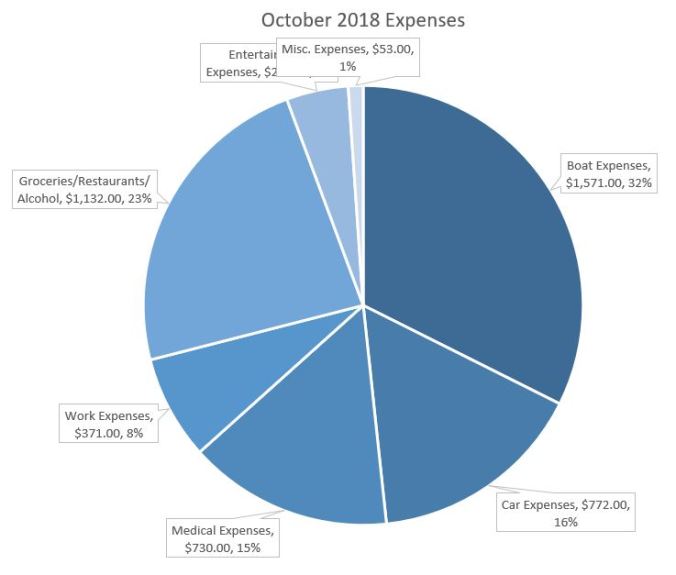

October 2018 Expenses

Total: $4,850

Debt sucks! This is one major reason that we’re getting into this lifestyle is to start living beneath our means and not be slaves to our debt. Right now, we’re paying for poor financial choices from our past and some damn sh*tty medical bills. Yes, our healthcare system is broken here in the US.

So here’s the breakdown:

Boat Expenses: $1,571

- Moorage, electricity bill, cell phone bill, boat loan, paid pump-outs, boat project costs, navigation/wind prediction tech, consultation, laundry

Car Expenses: $772

- Car insurance, car loan*, gas, licensing & registration *Brenden drives for Uber on the side so this extra income justifies the car loan for us.

Medical Expenses: $730

- Medical/Dental/Vision insurance, outstanding interest-free hospital bills, dentist and medical appointments

Work Expenses: $371

- Daycare, AT&T data wifi plan, parking fees for downtown Portland where Brenden works

Entertainment Expenses: $221

- Netflix, Hulu, Serius Satelite Radio, gym membership, Halloween costumes, Audible subscription/purchases, etc.

Food Expenses: $1,132

- Groceries, eating out, fast food, pizza, alcohol purchases

Miscellaneous Expenses: $53

- Schooling expenses, etc.

Where can we do better in our budgeting?

Short answer, everywhere!

I’m choosing to put my focus right now on our food expenses. This month, we spent an average of $36 per day on all of our food. My goal is to get this down to $20/day for November. I don’t know if we’ll be able to hit that but we’ll be giving it a shot! Do you see other potential places that we could scrape off some expenses? Leave a comment! 🙂

As always, thanks for reading. Please be gentle with us here on this post … it’s a bit uncomfortable to put it all out there for the world to see. Hopefully, we can help somebody understand what it is like, for us at least, to live on our sailboat while paying down debt and preparing to go cruising. Give us some encouragement and follow our adventures on Facebook and Instagram! Cheers! ~Rachel