I’ve been putting off posting this update because it’s not as encouraging as I had hoped… but the struggle continues and these posts, if nothing else, help me re-focus each month and initiate some good conversations between Brenden and I.

If you’re new to our blog, welcome! We’ve been posting our monthly expenses and budget reports each month for a little while in hopes of A) forcing us to be more intentional about our spending, and B) helping out anybody out there looking for some stats on costs for preparing a boat, and a budget, for extended cruising.

November 2018 Income

Our income for November was $5,064.00

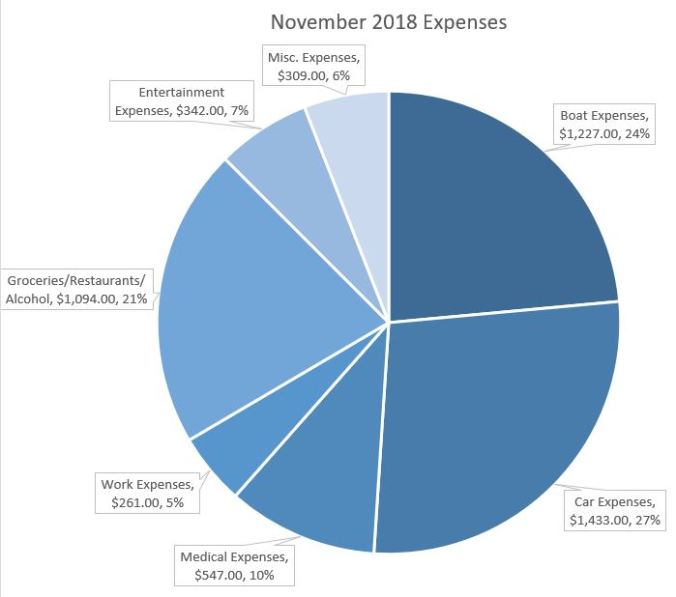

November 2018 Expenses

November 2018 Total Expenses: $5,213.00

Here’s the breakdown of our monthly expenses

Boat Expenses: $1,227

- Moorage, electricity bill, cell phone bill, boat loan, paid pump-outs, boat project costs, laundry

Car Expenses: $1,433

- Car insurance, car loan, gas bill, bicycle purchase, mass transit pass

- This expense went up this month because we purchased a bicycle for Brenden to start commuting to work. We will be selling one of our remaining vehicles and dropping to a one-car family. Eventually, obviously, we will be a no-car family and will just have the sailboat and dinghy. This is one step that we took in November toward preparing to go cruising. We haven’t sold the car yet though so that added income hasn’t come in.

Medical Expenses: $547

- Medical/Dental/Vision insurance, outstanding interest-free hospital bills

- No additional doctor/dentist visits this month

Work Expenses: $261

- Daycare, AT&T data wifi plan, parking fees for downtown Portland where Brenden works

Entertainment Expenses: $342

- Netflix, Hulu, Serius Satelite Radio, gym membership, Audible subscription/purchases, Breakfast with Santa tickets, RedBox, SkyZone trampoline park, etc.

Food Expenses: $1,094

- Groceries, eating out, fast food, pizza, alcohol purchases

Miscellaneous Expenses: $309

- Clothing, family obligations, Christmas presents, etc.

Major Takeaway: We’re Still Spending Too Much On Food!

I was really hoping that we would have knocked down that food budget a lot more after the sticker shock of October’s $1,132! Unfortunately, just trying to spend less on it didn’t really work for November so I’m trying another technique for December which separates out the food budget from the rest of our cash flow. We’ll see how this works… I really hope it helps!

Oh, we’ve also made a commitment to no more fast food. We spent over $200 in November on fast food- yikes! Which was even more than October. We spent a little on fast food at the beginning of the month but, once I gathered my data for this report and saw the November numbers, I decided this needs to be a crack-down item!

Happy Holidays everybody- thanks for reading and I hope this information helps somebody out there in their own planning and budgeting. Got tips for how we can save more? We’re starting to get serious here aboard Mosaic – send me your ideas and we’ll take them into consideration! Cheers! ~Rachel

Evan decided to get out his stash and count his money this month- he’s saving for a Nintendo Switch.