We’re a family of four in the Pacific Northwest. We’ve been living aboard our 1978 Fuji 40 sailboat for over two years as we’re prepping the boat and ourselves to get out there for long term cruising and traveling to explore this amazing world. Part of that process includes paying off debts from our past and working our finances into such a state that we can afford this lifestyle and live a life of fewer expenses, less “work”, and more adventure together as a family.

We’ve found that a monthly budget check-in helps keep us focused on our financial goals. Hopefully, it might also help you if you’re considering downsizing to live a life on the water, or in an RV, or any other form of ‘out of the box’ life.

1978 Fuji 40 SV Mosaic in the Portland Oregon snow – February 2019

Before we jump right in, I want to make a note about our budget this past month. We’re preparing to sell Brenden’s car, which will eliminate the car loan. First, though, we had some bigger ticket maintenance items to address on the Durango so that added an extra $500+ onto the expenses this month, too. So, let’s take a look at our income and expenses for January 2019.

January 2019 Income

Our total income for January 2019 was $6,480.00.

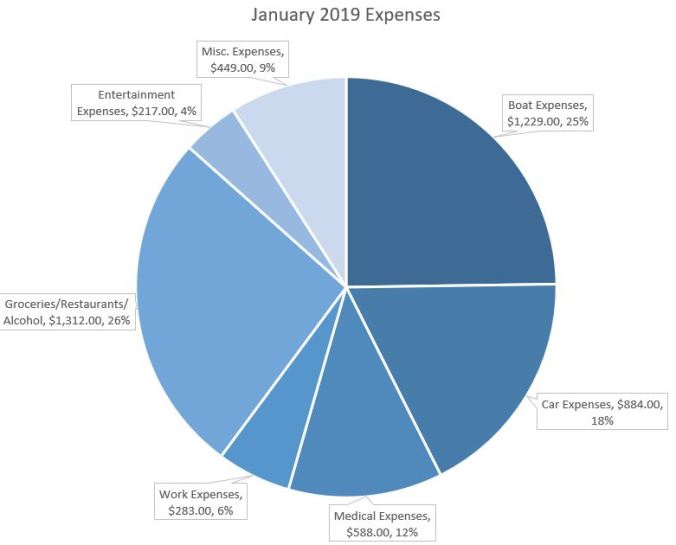

January 2019 Expenses

January 2019 total expenses: $4,962.00.

January 2019 Monthly Expenses Breakdown

Boat Expenses: $1,229

- Moorage, electricity bill, cell phone bill, paid pump-outs, boat project costs (Windlass)

Car Expenses: $884

- Progressive car insurance, brakes & oil change on the Durango

Medical Expenses: $588

- Medical/Dental/Vision insurance, outstanding interest-free hospital bills

- Several additional medical and dental visits this month as we found out that we will be forced to change our medical/dental/vision insurance as of Feb. 1 – our expenses will be roughly doubling

Work Expenses: $283

- Daycare, AT&T data wifi plan, parking fees for downtown Portland where Brenden works

Entertainment Expenses: $217

- Netflix, Hulu, gym membership, Audible subscription/purchases, etc.

Food Expenses: $1,312

- Groceries, eating out, fast food, pizza, alcohol purchases

Miscellaneous Expenses: $449

- Clothes and education

As always, the biggest culprit and opportunity for improvement is food. Boy, this month we even went higher. This is about double what we want to be spending. So far, for February, we’re trying to be on top of our expenses, especially food expenses, continually throughout the month instead of waiting for the end of the month and seeing how we did. Something’s gotta give.

As always, thanks for reading! Hopefully, we’ll be getting a blog post out soon about getting our windlass fixed! She’s operational! So exciting. 🙂 Cheers! ~Rachel

Evan and Kali exploring along the Columbia River where we live.